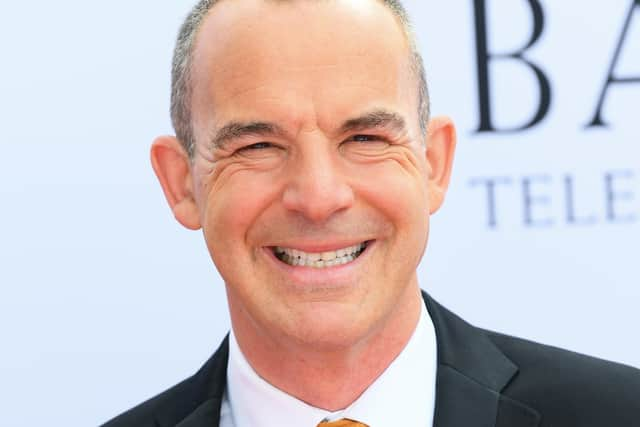

Martin Lewis fan reveals how they got an £8,500 refund from their council - check if you’re eligible too

and live on Freeview channel 276

A Martin Lewis fan revealed how a tip from the consumer champion helped her secure a £8,500 refund from her local council. The woman received the money via a council tax rebate after she found out he was paying too much.

The amount of council tax you pay is based on your band (A-H) - but you can challenge it if you think you are in the wrong band. If this is found to be the case, you can get money back for anything you’ve overpaid.

Advertisement

Hide AdAdvertisement

Hide AdIt will also mean you’ll pay less moving forward, too. Writing in the MoneySavingExpert’s newsletter, the woman said: “Thanks sooooooo much for the advice regarding wrong council tax bands on your show a couple of weeks ago.

“We have had a refund going back to 1993 from our local council of £8,500!!! “We are now a band less (F to E), so also pay £30 less each month - meaning I can afford an extra glass of bubbly.”

What is council tax and what are the different bands?

Council tax is an annual fee renters and homeowners must pay to their local authority to fund local services such as libraries and bin collections. If you live in England, the amount you pay is based on the value of your home on April 1, 1991.

Each home falls under a different band. These are:

- Band A - up to £40,000

- Band B - £40,001 to £52,000

- Band C - £52,001 to £68,000

- Band D - £68,001 to £88,000

- Band E - £88,001 to £120,000

- Band F - £120,001 to £160,000

- Band G - £160,001 to £320,000

- Band H - over £320,000

The bands are slightly different if you live in Wales. They are based on the value of your on April 1, 2003:

Advertisement

Hide AdAdvertisement

Hide Ad- Band A - up to £44,000

- Band B - £44,001 to £65,000

- Band C - £65,001 to £91,000

- Band D - £91,001 to £123,000

- Band E - £123,001 to £162,000

- Band F - £162,001 to £223,000

- Band G - £223,001 to £324,000

- Band H - over £324,001 to £424,000

- Band I - more than £424,000

How do I challenge my council tax band?

To challenge your council tax band, begin by finding out which one you are actually in. You do this by checking with your local authority or on the Government’s check your council tax toolon the Gov.uk website.

You’ll need to provide evidence you believe you are in the wrong code, however. You might have to find out what council tax bands your neighbours are in as if theirs are lower than yours, yours might need to be lowered as well.

If you live in England or Wales, you can challenge your council tax band online on the Government’s website. If you don’t have access to a computer you can call the Valuation Office Agency (VOA) instead. You can contact them by emailing [email protected] or calling 03000 501 501 (England) or 03000 505 505 (Wales).

If you live in Scotland, you can submit your challenge to an assessor based in your local Valuation Joint Board or your local council.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.